Hedge Fund Due Diligence

Most Hedge Fund scandals would be avoided with proper due diligence performed by experienced managers.

What's New:

More Educational Content coming soon

More educational content

to come. Sujects include double taxation of bonds and corporate governance.

More educational content

to come. Sujects include double taxation of bonds and corporate governance.

April 19, 2012: Death of a great investment counselor, Carl H. Otto

Updated: April 20, 2012

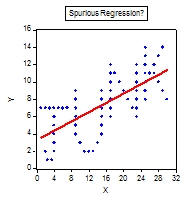

Spurious Models in Finance

When I started in Finance, I was surprised to see so many spurious models being used by market participants on both the buy side and the sell side. I must admit that these concepts are not well taught in statistical courses where data tend to be well behaved. They are unfortunately still being used today.

The term “spurious regression” was first used by Granger and Newbold (1974), pointing out the high but meaningless R-square and t-statistics in a regression involving some time series. Many other papers have been written on the subject. Yet, today, I still come across such improperly developed models by both quant and non-quant firms.

I remember an FX publication by a major Wall Street firm highly distributed for many years. The thick publication with colored country flags on its cover contained detailed currency models for each country together with exchange rate forecast for the coming months. Fortunately, the publication had enough details about the time series used in each forecasting equation together with their huge t-statistics and the equation huge R-square to quickly conclude that we had spurious models. I met the person responsible for such publication at a professional FX forecasting course in Europe and discussed with him the concept of spurious regression…

One famous academic professor have published numerous books on exchange rates and has lectured/consulted at many Wall Street & global organizations including State Street, Barclays Bank, Bankers Trust, Chase Manhattan Bank, Morgan Stanley, Credit Suisse, JP Morgan, Citicorp, Deutsche Bank, Bank of NY, IMF, and many others. No wonder why his spurious model approach has spread so much…

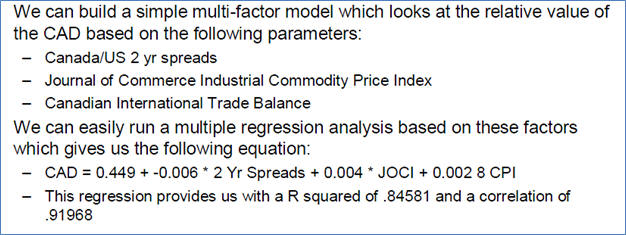

Here is a spurious model included by a local Canadian brokerage house in a recent (Dec 2010) presentation (the spurious model is used in hedging currency risk!):

Here is a hint: over the ten+ year regression, the Canadian dollar went from above 1.50 to parity… Looking at the above equation and its fit, we quickly see that this model is a typical example of spurious regression and cannot be used to hedge anything.

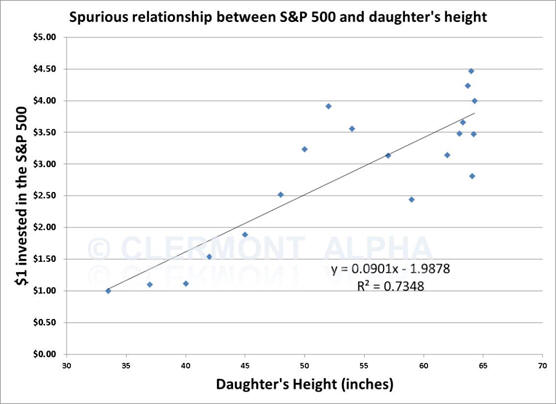

In my presentations, I often make the analogy with my daughter’s height and the market level. Here is a graphic showing that the S&P 500 is closely linked to my daughter’s height:

The R-square is quite high at 73.48% and the t-statistics of the coefficient (0.0901) of my daughter’s height is extremely significant at 6.86 ! I haven’t told my daughter that she has such an impact on the market. Since she is an adult now, she is not growing anymore which means that … the market won’t grow anymore! While this seems to be the case over the last few years, the above is a typical spurious model. Spurious models like this one are totally useless as many models I often encounter in some investment management firms who hire people without proper background and/or improper monitoring…

For more information on proper statistical modeling and how to build meaningful forecasting models, please contact us.

Dominic Clermont, ASA, MBA, CFA