Hedge Fund Due Diligence

Most Hedge Fund scandals would be avoided with proper due diligence performed by experienced managers.

What's New:

More Educational Content coming soon

More educational content

to come. Sujects include double taxation of bonds and corporate governance.

More educational content

to come. Sujects include double taxation of bonds and corporate governance.

April 19, 2012: Death of a great investment counselor, Carl H. Otto

Updated: April 20, 2012

Manager's Selection: Survivors always look better, whether they are skilled or not

(Summary of a working paper written on this subject by Dominic Clermont)

Most investors know about survivorship bias but do not fully understand the incredible damaging effect it has on their managers’ selection process.

While database of managers are sold as being free of survivorship bias, there is evidence of missing significant managers who disappeared due to extremely bad performance. Furthermore, I document that typical use of such database generates the same negative effect as managers disappearing from such database.

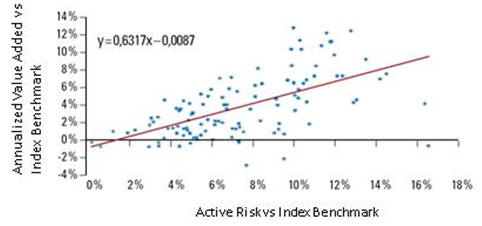

Investment consultants invite clients to follow their recommendations as they have excellent managers in their database. To illustrate their point, they show an analysis like this:

Their observations and recommendations are:

- There is significant value added from such active managers.

- There is a strong correlation between active return and active risk.

- Since return increases with risk, we should not be afraid of concentrated/more risky portfolios.

In my working paper, I show that such analysis is flawed, and the recommendation to invest in concentrated portfolios is also flawed.

I do two 10-year simulations of the return of two types of managers:

When I measure the ex-post historical IR of each group of managers in my simulation, I obtain an average IR of 0 for the group of non-skilled managers, and 0.3 for the skilled one – as expected. But there is a significant dispersion around these average IRs. Some managers are lucky and have an ex-post realized IR much larger than what they should have. Some are not lucky and have an ex-post realized IR much lower.

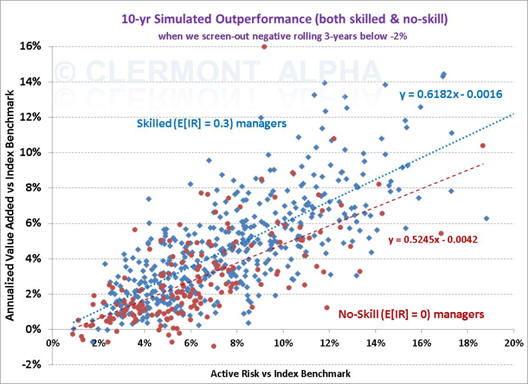

In practice, investors don’t get to see all managers. They get to meet only those who survived till today. I simulate such survival process by eliminating any managers with a rolling 3-year underperformance of –2% or less (I tolerate some negative performance as long as it is not below -2%). Such screening process which simulates some real life survival process has the effect of increasing the average IR of both the skilled and the non-skilled groups. And the increase is much larger for the non-skilled group! In fact, when we look at the chart of Value added vs risk, it looks very much like the real chart above for both groups!

I then overlay the survivors of the two groups to obtain the following chart:

The IR of non-skilled managers increases from an expected 0 to an ex-post IR of 0.52!

The IR of skilled managers increases from an expected 0.3 to an ex-post IR of 0.62.

Both groups of managers have unlucky managers with negative performance after 10 years. This is true even for the skilled group! The screening process gets rid of those unlucky managers which increases the average IR of the surviving managers.

On the chart, we can distinguish the skilled managers with the blue diamond, and the non-skilled managers with the red dots. In practice, we do not know that information. Therefore, imagine the above chart if we replace all red dots and blue diamonds by a black dot. How can you find the skilled managers based on performance?

We wished all managers would have a red dot or a blue diamond on their face to distinguish the skilled and the non-skilled managers…

In real life, the managers we meet are surviving managers who have all the reasons to smile – they survived with good returns! And we can’t distinguish the skilled and the non-skilled based solely on performance…

Managers’ selection is a lot more than looking at past performance. I just showed that even after 10 years, taking into account survivorship bias, one cannot distinguish between skilled and non-skilled managers. One has to do much more analysis of the manager and his strategy – which requires a level of expertise that many investors and consultants may not have.

The paper contains much more interesting analysis. In particular, I show that the survival rate of managers significantly decreases with risk for both skilled and non-skilled managers – something to keep in mind when looking at highly concentrated portfolios…

For a copy of the more detailed working paper:

Manager's Selection: Survivors always look better, whether they are skilled or not

For more information on Managers' Selection, please contact us.

Dominic Clermont, ASA, MBA, CFA